❓ Frequently Asked Questions: FHA vs. Conventional Loans

1. Which is better: FHA or Conventional loan?

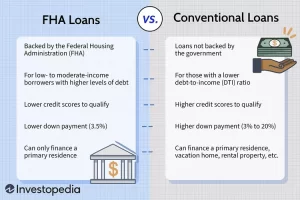

There’s no one-size-fits-all answer. FHA loans are better for borrowers with low credit scores or limited savings. Conventional loans are often a better long-term choice if you have strong credit and can afford a higher down payment, as they may offer lower overall costs.

2. Can I switch from an FHA loan to a Conventional loan later?

Yes. Many borrowers refinance their FHA loan into a Conventional loan later, especially to remove monthly mortgage insurance (MIP) once they build enough equity.

3. Do Conventional loans require mortgage insurance?

Only if your down payment is less than 20%. This is called Private Mortgage Insurance (PMI). The good news is that PMI on a Conventional loan can be canceled once you reach 20% equity, unlike FHA loans where MIP often lasts the life of the loan.

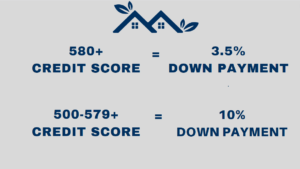

4. What is the minimum credit score for an FHA loan?

You can qualify for an FHA loan with a credit score as low as 500 (with a 10% down payment). If your score is 580 or higher, you may only need to put down 3.5%.

5. What is the minimum credit score for a Conventional loan?

Most Conventional lenders require a minimum credit score of 620. For the best interest rates and lowest PMI, a score of 740+ is preferred.

6. Can I use a Conventional loan to buy a second home or rental property?

Yes. Conventional loans allow you to finance primary residences, vacation homes, and even investment properties. FHA loans are only available for primary residences.

7. Are there income limits for FHA or Conventional loans?

No, neither FHA nor Conventional loans have income limits. However, your income must be sufficient to meet debt-to-income (DTI) ratio guidelines for the loan type you’re applying for.

8. Is the FHA loan only for first-time homebuyers?

No. While FHA loans are popular with first-time buyers, they are available to anyone who meets the credit, income, and down payment requirements. You can use an FHA loan even if you’ve owned a home before.

9. Can I get a loan with student loan debt?

Yes. Both FHA and Conventional loans allow borrowers with student loan debt, though the way that debt is calculated into your DTI ratio differs. FHA is often more flexible if your payments are deferred or income-based.

10. What’s the biggest difference between FHA and Conventional loans?

The biggest difference is government insurance. FHA loans are backed by the federal government and allow more flexible credit and income requirements. Conventional loans are privately backed, typically for borrowers with stronger credit profiles and higher down payments.