FHA Bankruptcy Guidelines

MORTGAGE-WORLD.com is your FHA loan experts with over 20 years of experience originating FHA loans. Since 2008 we have specialized in FHA bankruptcy loans for borrowers with less than perfect credit.

First-time homebuyers accounted for 82.7% of all FHA purchase loans in 2024.

- First-time homebuyers

- Not just for first-time home buyers

- First-time homebuyers

- Not just for first-time home buyers

2025 FHA Loan

- Low interest rates

- First time homebuyers

- Gift for down payment

- No credit score allowed

- 500 minimum credit score

- Non occupying co-borrower

- Seller paid closing cost up to 6%

- 3.5% down with 580 credit score

- FHA maximum debt to income ratio can be over 55%

- Manual underwriting maximum debt to income ratio is 40/50%

FHA Bankruptcy

FHA loans have been helping people become homeowners since 1934. Therefore a perfect credit score is not needed for an FHA loan approval . In fact, even if you have had credit problems, such as a bankruptcy, it’s easier for you to get an FHA loan than a conventional loan.

FHA Bankruptcy

For instance new FHA policy requires a minimum credit of 500 to buy a house. In the old days FHA did not require any credit score. These changes went in to effect in 2010.

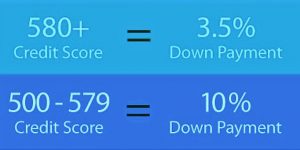

Borrowers with credit score above 580 require a 3.5% down payment. The down payment funds can be the borrowers own funds or a gift from a family member and up to a 6% seller’s concession is allowed.

If your credit score is below 580 new FHA changes require a 10% down payment. The down payment funds can be the borrowers own funds or a gift from a family member and up to a 6% seller’s concession is allowed.

To buy a home you will need a minimum credit score of 500. FHA does not have a minimum trade line requirement and FHA allows borrowers with no credit score to qualify for an FHA loan.

First time homebuyers

In today’s marketplace technology makes buying a home easier. Start the home buying processes by getting approved for a mortgage first.

When you make an offer the financing has been secured you have an actual loan approval. In fact, this gives the you more leverage and strength. According to the National Association of Realtors a home buyer will search for a property for an average of 12 weeks before writing a contract.

With a formal loan approval it becomes far easier to have an offer accepted and more importantly the offer will be accepted faster. The home buyer will be more successful by securing a loan approval earlier in the home buying process.

Current turn time to get a loan approval is 72 hours from completing an application.

Call Us 888.958.5382

Mortgage-World.com