If you’ve been waiting for the right time to refinance your mortgage in 2025, the good news is that market trends are finally moving in your favor. With interest rates beginning to stabilize and inflation easing, many homeowners are discovering that refinancing this year could significantly reduce their monthly payments or shorten their loan term.

Experts project continued improvement in mortgage rates throughout 2025 as the economy cools and the Federal Reserve maintains a steady stance on rate cuts. This creates a unique opportunity for homeowners who purchased during higher-rate periods to refinance and lock in better terms.

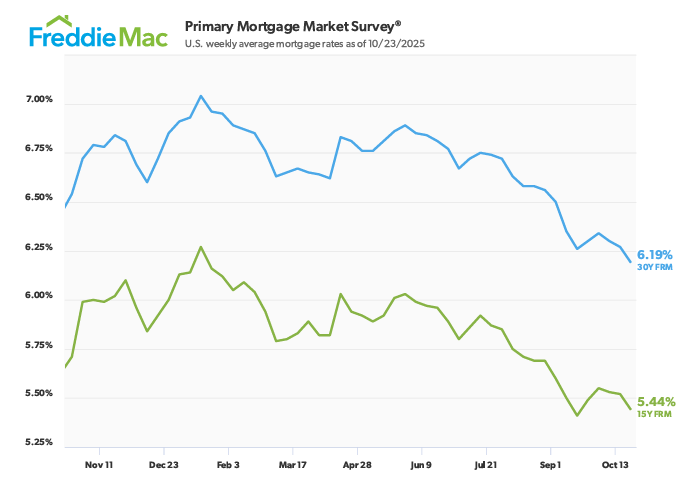

According to Freddie Mac’s rate outlook, average mortgage rates are expected to trend downward in the coming months, offering more flexibility for homeowners looking to save.

How Refinancing Can Save You Money

Refinancing your mortgage in 2025 can lead to savings in multiple ways:

-

Lower monthly payments: Take advantage of reduced interest rates.

-

Shorter loan term: Refinance from a 30-year to a 15-year mortgage and save thousands in interest.

-

Cash-out options: Use your home’s equity for renovations or debt consolidation.

Explore different loan programs to find one that fits your goals.

When Should You Refinance Your Mortgage?

You should consider refinancing if:

-

Your current rate is 0.5%–1% higher than today’s rates.

-

You’ve built significant home equity since purchasing.

-

Your credit score has improved since your last loan.

What to Expect During the Refinance Process

The refinance process is similar to your initial mortgage:

-

Apply and get pre-qualified.

-

Lock your new interest rate.

-

Submit income and asset documentation.

-

Appraisal and underwriting review.

-

Close and enjoy your new, lower payment.

Is Refinancing Worth It in 2025?

Absolutely — if your current mortgage rate is higher than today’s averages, refinancing could save you thousands over time. And as the mortgage market in 2025 continues to strengthen, homeowners who act early are positioned to benefit the most.

Refinancing your mortgage in 2025 isn’t just about lowering your interest rate — it’s about building long-term financial stability. With rates trending downward and lenders offering flexible programs, now is an ideal time to explore your options. Apply online today and see how much you could save by refinancing your mortgage in 2025.

Comments are closed.